Tax Relief Solutions

Tax debt can be devastating to a person’s finances, livelihood, and well-being. Taxpayers who find themselves in tax debt are often unaware of where to start, who to turn to, or what programs are offered. Because of that, many apply for programs they do not qualify for, sometimes leaving them in an even worse situation.

There are many IRS programs that help with different tax debt situations. Tax programs can greatly lower a tax debt, and protect against aggressive collection action. While it is recommended for taxpayers to pay off their entire tax debt, many taxpayers are just unable to do so, and therefore, tax debt agreements are the best way to avoid added interest and penalties, and IRS collection actions.

Rucker Tax & Consulting is experienced with many tax solutions, including:

- Installment Agreement: This solution is a contract between the taxpayer and the IRS where the taxpayer agrees to make regular monthly payments to the IRS.

- Offer in Compromise: This solution is an agreement between the taxpayer and the IRS that allows the taxpayer to settle their tax debt for less than the amount owed.

- Penalty Abatement: This solution is an IRS program where the IRS removes some or all of the accumulated penalties from the tax debt.

- Innocent Spouse Relief: This solution is an IRS tax relief program through which a spouse can claim ignorance of an understatement of due taxes.

- Currently Not Collectible: This solution is a program offered by the IRS for taxpayers experiencing an economic hardship.

- IRS Appeals: This solution can help a taxpayer who disagrees with the assessed tax debt amount, or the IRS’ determination of their IRS program application follow through the appeals process.

- Compliance: This solution may include many different factors, such as filing unfiled returns, refilling Substitute Returns filed by the IRS, educating taxpayers to help avoid filing mistakes in future years.

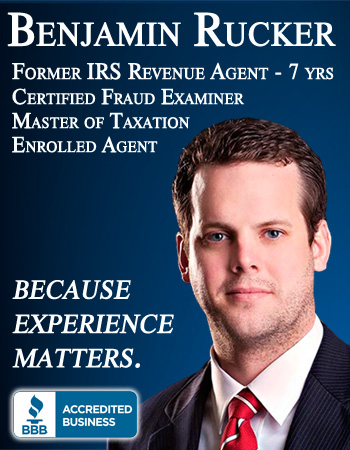

Rucker Tax & Consulting has consulted with over 128,000 taxpayers and seen over 3.3 billion dollars in tax debt since its inception. We have worked with individual W2 employees, self employed individuals, and small businesses, and understand the qualifications of each IRS solution to make sure taxpayers get the best tax debt resolution possible.