When a taxpayer has a tax debt, the IRS will take certain measures if the taxpayer does not make arrangements to satisfy their debt. Some tax problems can be handled easily with a simple phone call to the IRS, but once a tax debt reaches a certain amount, taxpayers often have difficulty paying and the IRS can become very aggressive.

In order to recover the debt, the IRS may use enforced collection actions against a taxpayer, which can be devastating to a taxpayer’s finances. These collection measures include:

- IRS Tax Liens: The IRS will place a claim against a taxpayer’s property or person as collateral for a tax debt.

- IRS Bank Levies: The IRS will seize funds from a taxpayer’s bank account(s) or accounts receivable for an IRS tax debt.

- IRS Wage Garnishments: The IRS will seize a portion of a taxpayer’s wages, paycheck, or salary to satisfy a tax debt.

These collection actions may have significant adverse affects to a taxpayer’s finances and credit, making it difficult to borrow money through loans from the bank or other private lenders, buy or sell a home, or even rent property. The IRS can leave a taxpayer without a sufficient amount of money to live, and even take away their freedom by putting taxpayers in jail.

Other problems that a taxpayer faces when charged with a tax debt include:

Payroll Tax Issues: The IRS can take serious measures, including collection actions, to recoup a payroll tax debt from business owners, executives, and in some cases employees of a business.

- Penalties & Interest: The IRS will charge penalties and interest on a tax debt until the full tax debt is paid.

- Unfiled Taxes: The IRS will not negotiate an agreement with a taxpayer who is unfiled for any tax years.

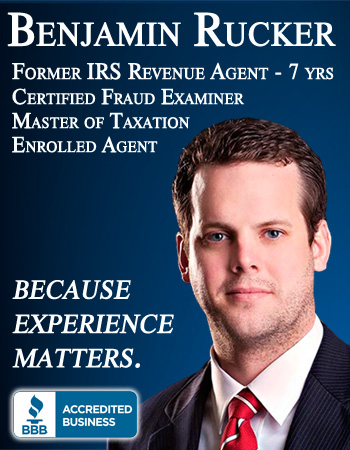

It is essential that a taxpayer be up-to-date on all filings before entering into any contracts with the IRS. Rucker Tax & Consulting’s team of licensed tax professionals, enrolled agents, and tax professionals are equipped to handle these common tax problems many taxpayers face when they have a tax debt, giving taxpayers the best line of defense against the IRS.