Curious to know how much money has not been claimed during tax season? The total for just one year may surprise you. The mere mention of taxes is enough to make most Americans start sweating. Taxes are technical and complicated, and no one wants to find out they owe the government more money. However, there is a lot of money out there left unclaimed that could be yours when filing taxes with professional help. The following infographic highlights some of these total sums as well as other interesting facts about tax filing:

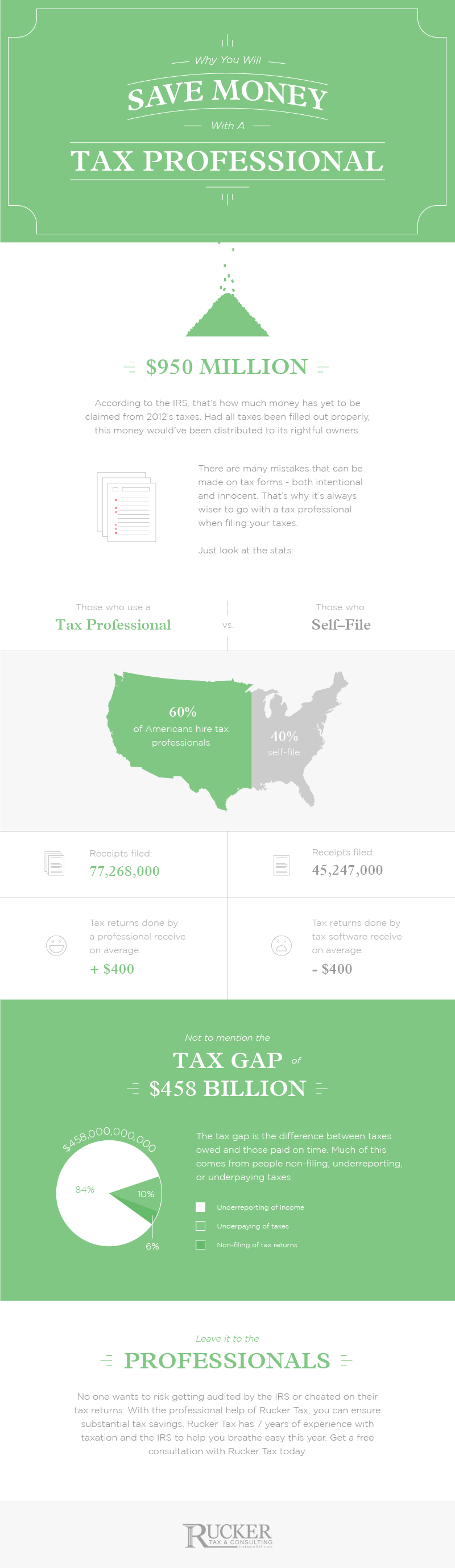

What would you do with $950 million? The IRS has reported that for the year 2012 alone, there is nearly one billion dollars yet to be claimed by the public. This money could have been distributed through proper tax return filing.

There are many mistakes that can be made on tax forms – both intentional and innocent, so it’s no wonder that there’s so much money left unclaimed. Regardless of intention, these mistakes are all carefully calculated by the IRS to a grand total of around $450 billion dollars. $271 billion of those dollars result from non-filing, underreporting, and underpaying individuals.

The most common reporting errors are:

- Reporting of net income from flow-through entities

- Reporting of proprietor income and expenses (ex: bad debts)

- Reporting various deductions

The IRS does not let all that money slide away easily. They use a process called classification to identify tax discrepancies and determine the type of audit appropriate. Of the $450 billion missing, they recoup about $65 billion or 14%.

Tax Professional or Self-File?

When tax season does roll around again people have a wide variety of options. Americans can file their own taxes, pay for an online software, or hire a professional to do their taxes for them. About 45 million self-file while 77 million use tax professionals.

According to a CBS News report, when online programs such as TaxAct were compared with using a tax professional, tax professionals proved to be more profitable. The tax professional earned roughly $400 more in the client’s tax return.

Yes, taxes can be annoying or scary. Yet, improperly filing your taxes could result in a significantly smaller tax return. Benjamin Rucker is a former IRS Agent who knows the ins and outs of IRS audits and operations. For help with taxes, schedule a free consultation with Rucker Tax today.